China’s Ministry of Commerce put out a list of products in late March, warning of 15% tariffs on products including wine, fresh fruit, dried fruit, and nuts. On April 1, the tariffs became reality.

The move is “in order to balance the Aluminum products impose tariffs on losses caused by Chinese interests” according to a Google translation of the announcement.

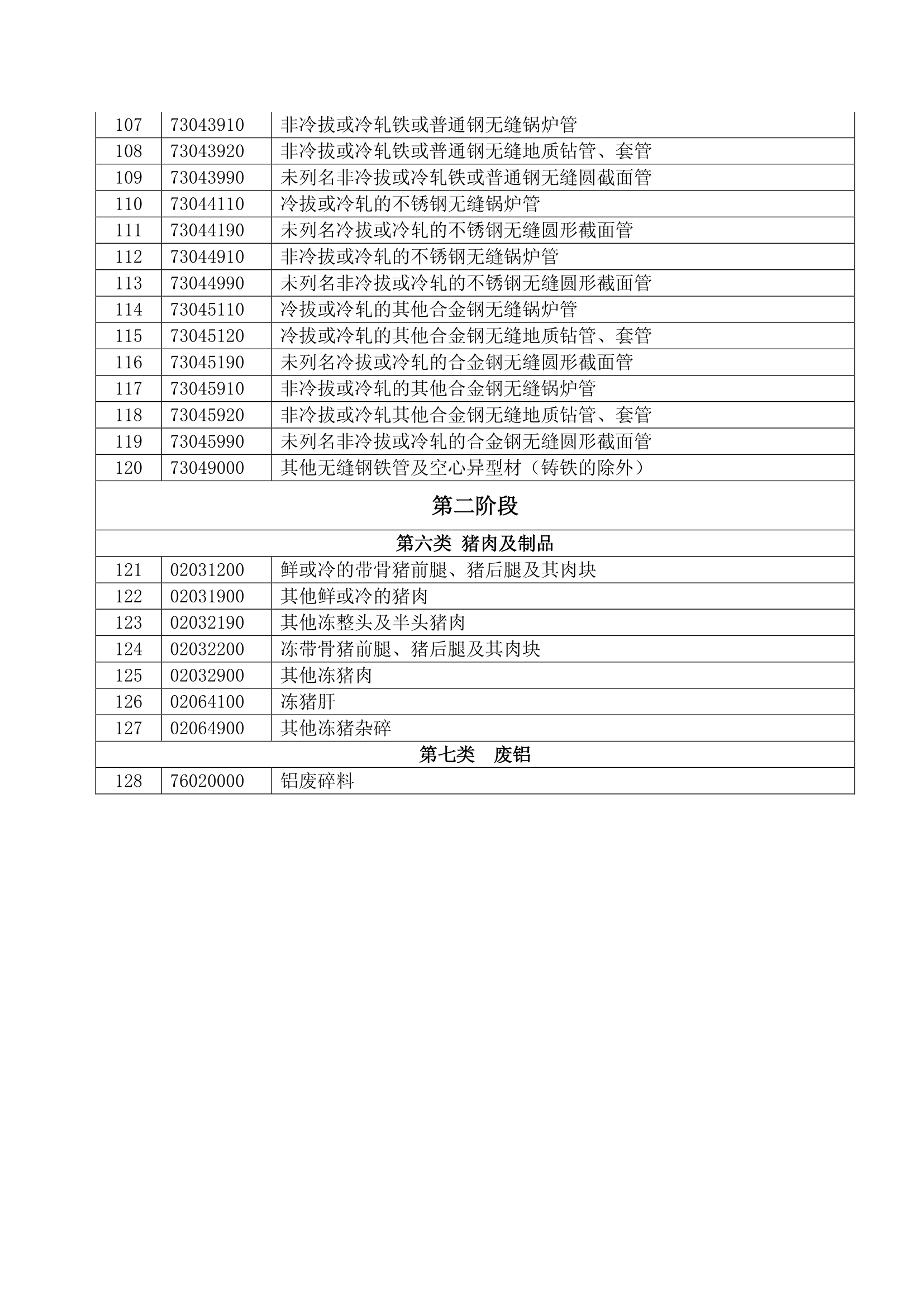

China is taking the measures against the 128 U.S. goods overall including steel pipes “if it cannot reach an agreement with Washington” CNBC reported.

The tariffs won't necessarily be all bad news, experts say.

“I urge President Trump to return our nation to a strategy of opening markets and resolving trade concerns through multilateral negotiations, like the Trans Pacific Partnership," Aguierre said in the release. "The current path of tariffs and trade wars is sure to result in tremendous harm to California agriculture and future wine exports.”

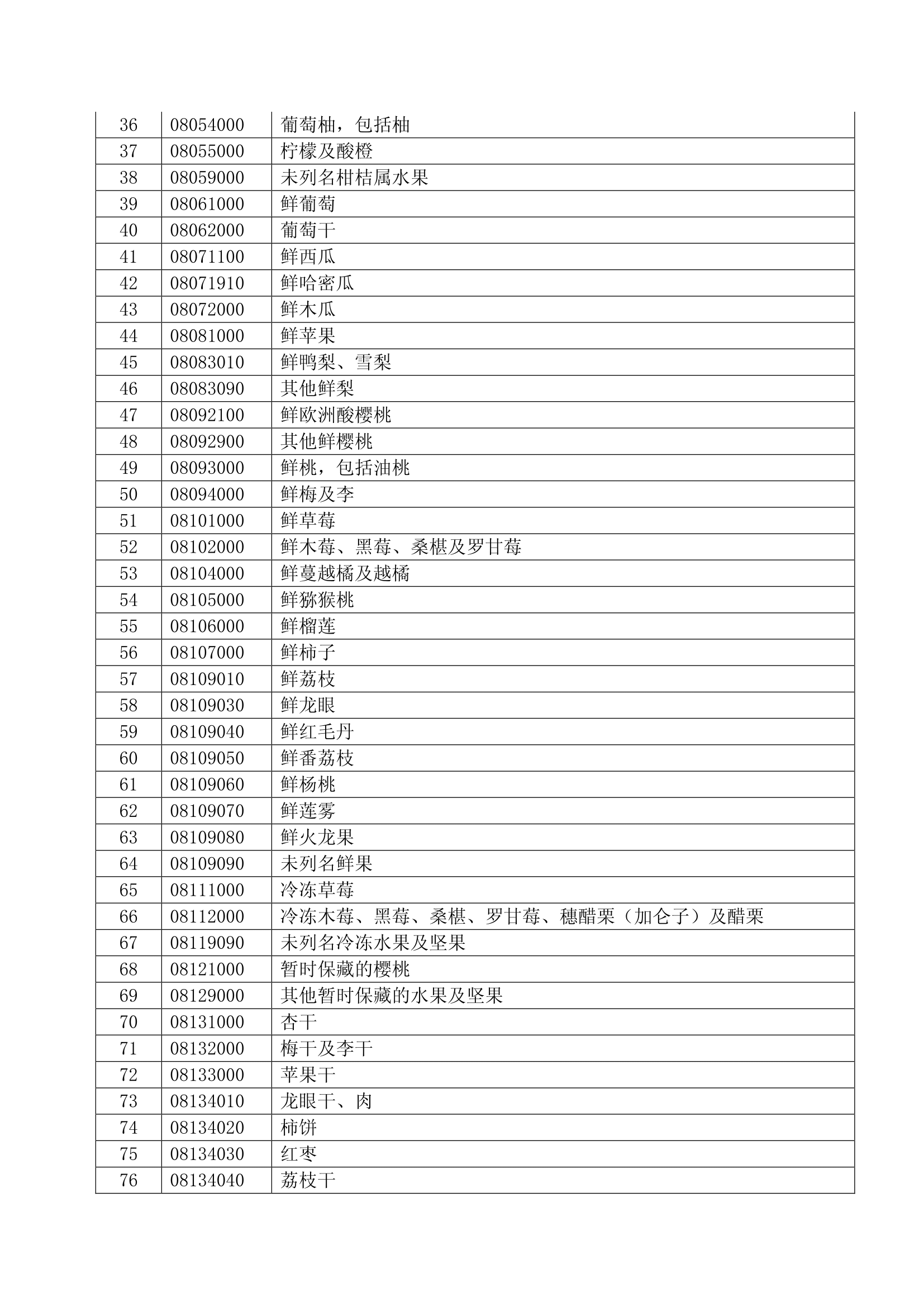

Beyond the items named in the image above, the list includes international tariff codes for several key U.S. and California agricultural exports, including the following products:

- 08021100, Almonds in shell

- 08021200, Almonds, shelled

- 08023200, Fresh, dried, walnuts

- 08023100, Walnuts, in shell

- 22042100, Wine of fresh grapes

- 22041000, Sparkling wine

- 08061000, Grapes, fresh or dried

Will the Chinese moves have a big impact on prices? Each crop has its own market dynamics playing out. Almond prices rose recently following several freeze events that may impact yields this year, which could offset the impact of Chinese tariffs. More on the freeze here.

In recent years, almond exports to Asian export markets have grown rapidly. The Almond Board's position report shows 32% growth in exports to Asian countries in 2017/2018 versus the year before, with a 21% rise in exports to China.

For walnuts, the Walnut Board has worked to expand export markets, but China remains a small slice of the total. China itself grows walnuts, but consumes a large percentage, which means it exports far less to other countries than California growers do.

Below are USDA export stats from 2016 for tree nuts including almonds and walnuts.

“Although China produces the most walnuts, they're not the leader in world trade, that's the U.S. at 67%," said Claire Lee, Assistant Marketing Director for the walnut board at a presentation for growers.

Ceres Imaging will continue to provide information for growers on this topic as it becomes available.