When China warned of impending tariffs last week, experts differed on what the result would be for each California crop: It may mean tree nut exporters see some benefit from Chinese enforcement cutting down on under-the-table imports.

Meanwhile the California Association of Winegrape Growers put out a statement encouraging President Trump to return to the bargaining table to avoid agricultural tariffs.

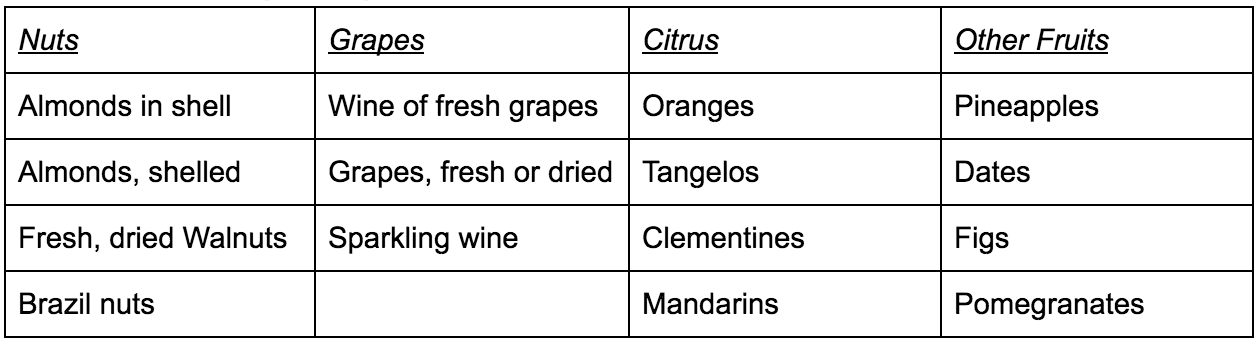

How will the tariffs affect growers? CAWG put us in touch with the experts at Gomberg, Fredrikson & Associates for a Q&A. You can find answers to several key questions below this table of crops that are targeted.

Selected crops targeted by China tariffs

Q. How important is China as a growth market for California wine?

Jon Moramarco, Managing Partner, Gomberg & Fredrikson: There are not very many growth markets for wine exports around the world. Most other countries look at the U.S. as one of the most attractive countries to export wine to.

China is another key country for exporters with a growing appreciation for wine and a population of over 1 billion people. In this respect it is a very important export market for California wines.

Q. Will this have an outsized impact on any specific varietals?

JM: Unfortunately exports are not tracked by varietal so it is difficult to say which varietals will be most impacted.

Generally wine sales in China skew more to red wines so red wines will likely see a bigger impact.

The average value of a case exported to China is roughly $60.00 per case which would indicate wine and grapes from the North Valley and Central Coast would be most impacted.

Q. What's the projection, if CAWG has one, for price changes or total export value change due to this tariff?

JM: The UK is the only market where we have recently seen price changes of over 15%. This was due to BREXIT and the weakening of the Pound Sterling. From this, US exports to the UK have seen about a 20% decrease in volume with the majority of this impacting packaged wines as opposed to bulk wines.

The weakening of the Pound Sterling was across most major currencies so this impacted most wine-exporting countries.

This would indicate that a 15% tariff would reduce imports of US wines into China by at least 20% and likely more since other countries would not be impacted.

Ceres Imaging will continue to provide information for growers on this topic as it becomes available.