“Ceres’ real-time risk detection system identified five agricultural loans with high-risk signals linked to late planting, prompting loan officers to carry out targeted field inspections. These inspections verified that planting occurred well past the final plant date; disbursements were halted to prevent overfunding, an intervention that ultimately helped avoid approximately $2.5 million in potential risk exposure.”

Proven Loss Prevention

The Visibility Gap in Ag Lending

Lenders are expected to manage crop risk without actually seeing the crop. Traditional credit assessments rely heavily on historical performance, offering no visibility into what’s happening in the field today. This blind spot creates real risk when crops underperform, diminishing the value of the collateral before lenders have a chance to respond.

- Risk is Based on the Past, Not the Present: Risk is assessed using last year’s data, with no real-time insight into current conditions.

- Reliance on Grower Updates: Without independent field intelligence, lenders rely on grower updates that can overlook or obscure emerging issues.

- Too Little, Too Late: Manual inspections happen late in the season and rarely cover every acre, leaving problems undetected.

Loan Risk Monitor: Field Level Insight, Loan Level Action

Prioritize outreach, inspections, and potential interventions by leveraging field-level visibility into loan-level risk. With the Loan Risk Monitor, your team can monitor and mitigate in-season crop-driven credit risk at every stage of the ag loan lifecycle, all through a single, color-coded signal for each loan.

Want to see how the Loan Risk Monitor works in your portfolio?

.png)

Built for Lending and Risk Officers

The Loan Risk Monitor was designed with your workflows in mind, giving your team fully explainable metrics designed to enhance your team’s decision consistency, accuracy, and speed.

Whether you’re reviewing new applications or monitoring your loan book mid-season, the Loan Risk Monitor helps your team make smart, confident calls quickly.

With full-field context delivered in a clear format, your team can:

- Proactively spot and address at-risk loans across your portfolio before issues escalate

- Reduce dependency on field inspections by reviewing analytics for every acre

- Improve portfolio-level visibility by staying up to date on exposure throughout the Ag loan lifecycle

- Free up loan officers to focus on strategic engagement instead of data gathering

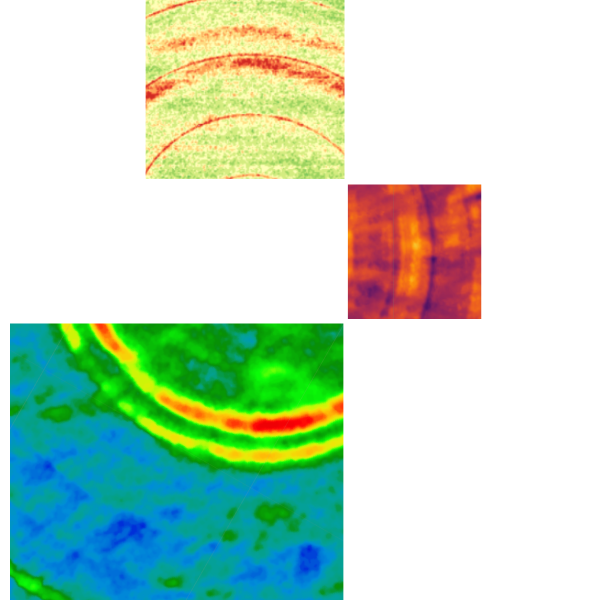

From Field to Flag: How Ceres Informs Every Risk Signal

Behind every loan risk signal is a stream of crop-specific data captured throughout the ag loan lifecycle. CeresAI translates real-time field conditions into clear, explainable signals that help you act with confidence.

- Planting: Verify what was planted, where, and when by confirming crop types and planting dates against MPCI deadlines.

- Mid-Growth: Monitor crop development and benchmark performance against regional norms.

- Pre-Harvest: Assess late-season performance and forecast yield to prepare for payout decisions or engagement.

Turn Insights Into Confident Actions

Lenders use Ceres to:- Enhance loan disbursement timing with verified field data

- Support strategic conversations with borrowers throughout the season

- Prioritize engagement where operational signals suggest deeper review

- Strengthen compliance and documentation with verifiable insights

Visualize the Future of Modern Ag Lending

Picture this:

- - You can evaluate a portfolio in minutes, with confidence in the data.

- - Each grower relationship is informed by verified, timely insights.

- - Your credit team collaborates seamlessly with field-level awareness.

- - You scale your lending strategy while maintaining strong portfolio health.

“Overall, 87% of [agriculture finance] respondents expect climate change to pose a material risk to their businesses.”

“[Ceres] saved us a ton of time, since we didn't have to do as much surveying of individual fields.”

“After investigating several drone, satellite and aerial imagery options, Ceres AI was found to provide the best results at an economical price.”