So far 2018 has thrown challenges at almond growers, and some serious question marks:

How bad was the freeze damage? Were bees able to pollinate well despite cold and rain? Will increased bearing acreage lead to a new all-time record?

Prices jumped by 40 or more cents after the freeze, according to a position report from the Nut Exchange, with NPS 25/27 reaching $3.60 and blanchable standards at $2.75.

Here’s a look at how prices may respond to orchard adversity from Brian Ezell, vice president at Wonderful Pistachios & Almonds, with some historical context.

“Right after the freeze, the only data we had about temperatures that low and their impact on bloom was a UC Davis Study which suggested we shouldn’t have any crop left out there based on the low temperatures seen in most almond growing areas,” Ezell said. “Once we got into mid-March, growers felt better about things as they could clearly see they would have a reasonable amount of crop to harvest this coming fall.”

Ezell said that the recent price levels since late March 2018 are based on a market sentiment that 2018 crop yields will be close to last year but not up to the pre-harvest potential of 2.5 to 2.6 billion pounds that many thought would be achieved.

“Based on what we are hearing from other growers up and down the state, and in looking at a lot of Kern County acreage, I don't see an upside potential much above the 2.26 billion we harvested in 2017,” Ezell said. “A 2018 crop below 2.2 billion gross will likely lead to higher prices moving forward, and anything less than 2.1 billion would likely have a major impact on future pricing–a rise of 50 cents a pound or more based on past history.”

“2018 peak prices could see increases of more than 50 cents a pound between now and October, as seen in the during the 2014 crop year–only if the 2018 gross crop falls below a 2.1 billion pounds figure,” he said. “This would be a scenario we would like to avoid, since the likelihood that the bloom in 2019 is impacted to the degree seen this year is low.”

Ezell pointed to the increase in bearing acreage as a complicating factor.

“With even more bearing acres expected to be harvested next year in 2019, trying to manage sales from a very low volume year to possibly a very high volume next year is difficult for both buyers and sellers,” Ezell said. “Although not always achievable, we always hope that prices can remain somewhat stable as we know this stability generates strong long-term demand.”

Historical context

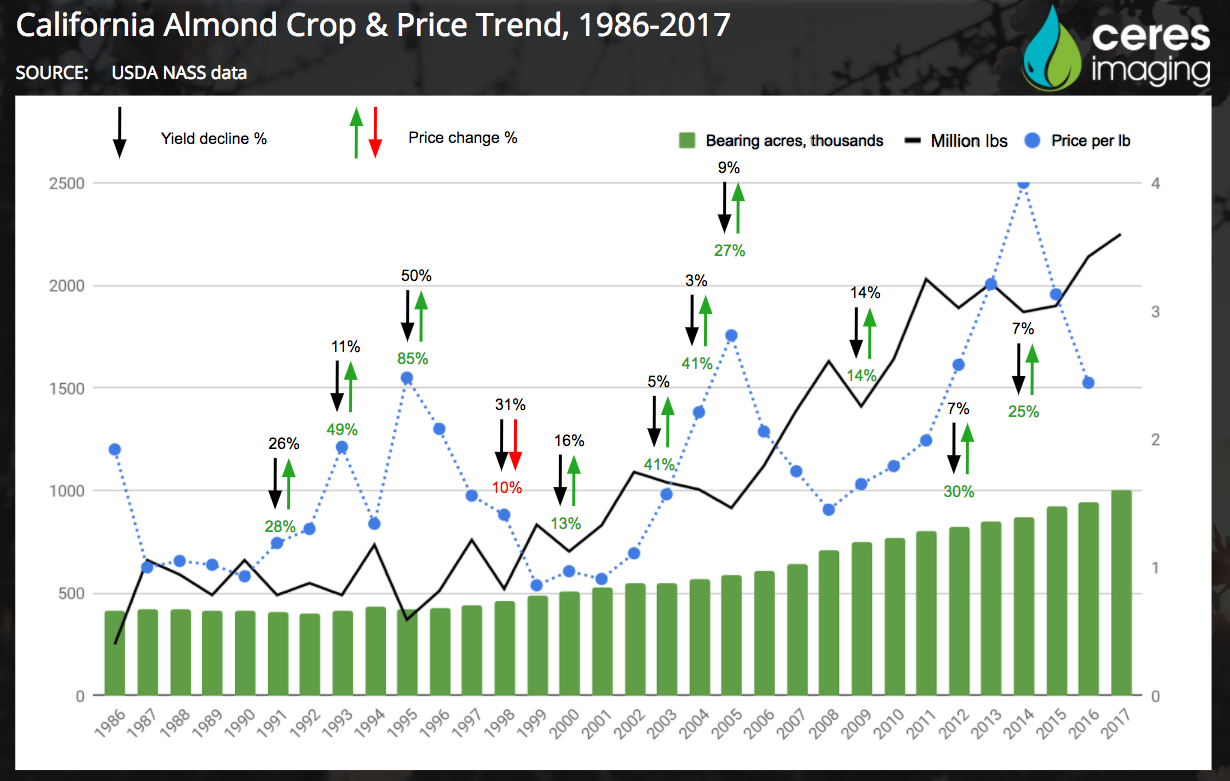

There have been 10 seasons with production declines for the California almond industry since 1985, as seen in the chart above, which uses USDA NASS data.

Only once did prices fall along with crop yield, in 1998.

Even with that drop taken into account, prices increased by an average of 31% in those 10 seasons.

There were five dip years through 2000, and five after.

In the five through 2000, the average crop decline was 27%. Since then, the average dips shrunk to 7%.

But that hasn’t changed the price response: for both periods, prices increased by about 30% in response. For more detail see the table below.

What’s the upshot?

Supply declines from 2003-2016 tended to be smaller than declines in the prior 15 years, but prices rose in response by about the same amount, an average rise close to 30%.

No one knows for sure what the future holds.

But Ezell is looking forward to big hints in the near future.

One thing he’s watching out for is the impact to the nut set of the “June Drop,” which actually happens in early May in most years. This is how the trees adjust their nut load and decide what will make it to harvest, and what won’t. The next important milestone is the release of the annual Terra Nova Trading Almond Estimate Report, which should be released within the next week.

Ezell said the report is generally very accurate, having predicted the gross crop size within 1% in two of the last three years.

“Once Terra Nova’s estimate is released...the industry will finally have a number to pivot off of and both buyers and sellers can then determine their ‘go-forward strategy,’” Ezell said. “Until then, the market remains biased and lacks fluidity due the wide range of opinions by individual growers, individual buyers, and individual handlers as to what they think the crop will be for 2018.”